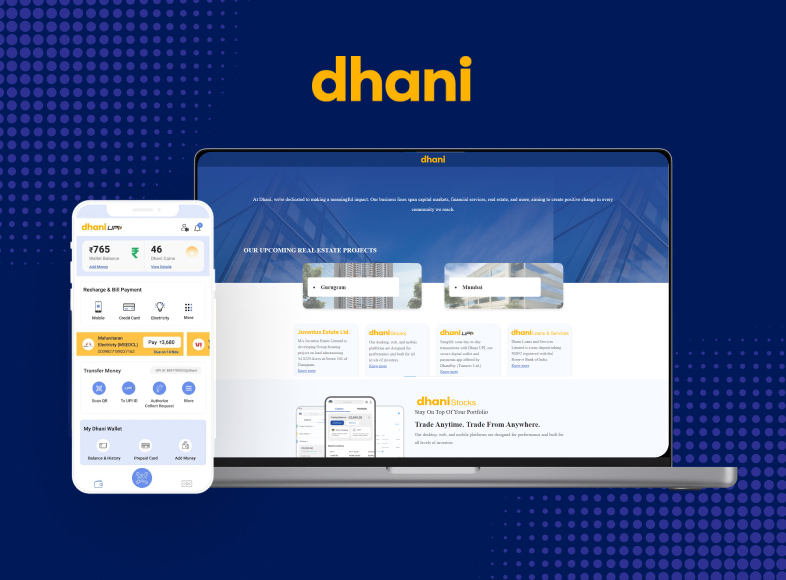

Dhani: Loans and Financial Services

Dhani Loans and Services is a leading financial platform offering a wide range of products, including personal loans, credit lines, insurance, and investment options. The newly designed website focuses on delivering a seamless user experience, enabling customers to access financial products with ease and transparency. The goal was to create a professional and user-friendly platform that caters to diverse financial needs while emphasizing trust and reliability. The Solution Modern and Professional Design: Developed a clean, user-centric design that reflects the brand’s commitment to financial empowerment. Responsive Layout: Built a fully responsive website to ensure accessibility across desktops, tablets, and mobile devices. Product Highlight Sections: Created dedicated sections for loans, credit, and other financial products, showcasing key benefits and features. Quick Loan Application Process: Integrated a streamlined and intuitive loan application system to enhance user convenience. Personalized User Dashboard: Designed a secure login portal for users to manage loans, track payments, and access their financial profiles. Advanced EMI Calculator: Added an interactive EMI calculator to help users plan their finances effectively. Secure Transactions: Implemented encryption protocols to ensure secure data handling and financial transactions. Multi-Language Support: Included multi-language functionality to cater to a diverse customer base. Live Chat Integration: Provided real-time customer support with a live chat feature to address user queries. SEO Optimization: Optimized the website for search engines to improve visibility and attract potential customers. Key Features Loan Application Portal: An intuitive interface for users to apply for personal loans and track their application status. EMI Calculator: A user-friendly tool to calculate equated monthly installments for better financial planning. Secure User Dashboard: Personalized access for users to manage accounts, payments, and services. Mobile-Friendly Design: A responsive interface for a seamless experience across devices. Real-Time Support: Live chat and FAQs to assist users in resolving their queries efficiently. Results Increased Loan Applications: Simplified application process and responsive design led to higher loan applications. Improved User Engagement: The intuitive design and features increased time spent on the website by users. Higher Customer Satisfaction: Real-time support and transparency built trust and improved customer retention. Enhanced Financial Awareness: Tools like the EMI calculator empowered users to make informed financial decisions. Broader Reach: Multi-language support and mobile responsiveness expanded the customer base across demographics. The Dhani Loans and Services website now stands as a reliable and user-friendly platform that simplifies financial processes and empowers users to achieve their financial goals with ease. Technologies Used Angular Frontend MongoDB Database Node JS Backend React Native Framework

Savings: Empowering Smarter Financial Decisions

Savings is an Australian financial comparison website designed to provide users with valuable insights and tools to compare financial products, including home loans, car loans, and savings accounts. The goal of this project was to develop an intuitive, data-driven, and user-friendly platform to help users make informed financial decisions effortlessly. The Challenges Complex Data Integration: Handling large datasets from multiple financial institutions and ensuring accurate real-time comparisons. User Experience Optimization: Designing a clean, responsive interface for users with varying levels of financial literacy. Performance: Ensuring fast load times and seamless navigation despite high data volume and traffic. Dynamic Filtering and Comparison: Providing real-time filtering and personalized recommendations based on user input. Regulatory Compliance: Adhering to Australian financial regulations while displaying sensitive financial data. Mobile Responsiveness: Building a platform that performs flawlessly across all devices and screen sizes. Security: Protecting sensitive user data and ensuring compliance with data privacy laws. Scalability: Preparing the platform to handle increasing traffic and data volume as the user base grows. Content Management: Enabling the admin team to easily manage articles, blogs, and updates without technical assistance. Third-Party API Integration: Seamlessly integrating APIs from banks and lenders to fetch the latest rates and offerings. The Solution Advanced Data Integration System: Built a backend system to handle, validate, and display financial data from multiple sources in real-time. User-Centric Design: Developed an intuitive UI/UX that simplifies complex financial concepts, ensuring a user-friendly experience for all demographics. Optimized Performance: Implemented caching strategies and optimized code for lightning-fast load times and smooth navigation. Dynamic Comparison Tools: Designed real-time filtering, sorting, and comparison tools tailored to users’ financial needs. Mobile-First Approach: Created a fully responsive design with optimized performance for mobile and tablet users. Compliance Framework: Integrated regulatory compliance checks to ensure adherence to Australian financial laws. Robust Security Measures: Applied encryption, secure authentication, and data storage practices to protect sensitive information. Scalable Architecture: Used cloud-based solutions to ensure the platform can scale as the user base and traffic grow. Content Management System (CMS): Built a custom CMS allowing the admin team to manage updates, blogs, and news efficiently. Seamless API Integration: Integrated APIs from financial institutions to fetch real-time interest rates, loan options, and more. Key Features Comprehensive Comparison Tools: Real-time comparison of loans, savings accounts, and financial products. Interactive Calculators: Tools like loan repayment calculators and savings planners to help users make informed decisions. Personalized Recommendations: Filters and dynamic results based on user preferences and requirements. Mobile Responsiveness: Optimized performance for a seamless experience across devices. Educational Content: Regularly updated articles, blogs, and financial tips to empower users with knowledge. Results Enhanced User Engagement: Increased user retention due to an intuitive interface and personalized experiences. Faster Decision-Making: Users can now compare and select financial products in real-time. Increased Traffic: A significant rise in daily traffic due to better performance and SEO optimization. Regulatory Compliance: Successfully adhered to Australian financial standards, enhancing trust and credibility. Scalable Growth: The platform is now prepared to handle exponential growth in users and data volume. Technologies Used Angular Frontend Java Backend